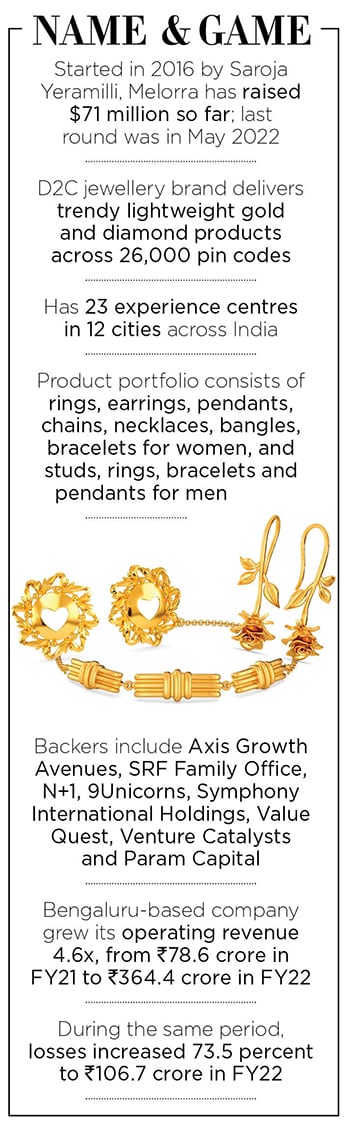

Beating the odds: Why Melorra's Saroja Yeramilli believes being a solo woman founder is the toughest job

The founder and CEO of the D2C jewellery brand had to face several odds, lows and rejections. But the tenacious founder refused to give up

Saroja Yeramilli, Founder and CEO, Melorra

Image: Hemant Mishra for Forbes India

Saroja Yeramilli, Founder and CEO, Melorra

Image: Hemant Mishra for Forbes India

June 2015, Bengaluru. It was a reality check for Saroja Yeramilli. The rookie founder was convinced that her glittering track record would be worth its weight in gold in her bold new innings. Buoyed by her celebrated past, the 47-year old seasoned corporate honcho had reached out to one of her investment banker friends to find out if he would be keen to handle the mandate of raising funds as she was about to step into an entrepreneurial journey with her venture to manufacture playful, comfy and trendy jewellery.

Yeramilli’s buddy, though, was astonished at the naivety of the first-time founder. “Aapke paas 4-5 slides ka business plan hai, koi revenue nahin hai, product nahin hai, proof of concept nahin hai…aur aap paise raise karna chahte ho…[You just have a business plan of 4-5 slides. There is no revenue, no product or proof of concept and you want to raise money],” he laughed at her face. “Chuck the idea. It’s impossible,” he suggested to his friend who kept mum for a few minutes. “He is a banker, so he might have a point,” wondered Yeramilli, who was rolling out Melorra, an online jewellery brand. The idea was to disrupt the traditional way of selling, buying, making and perception of jewellery.

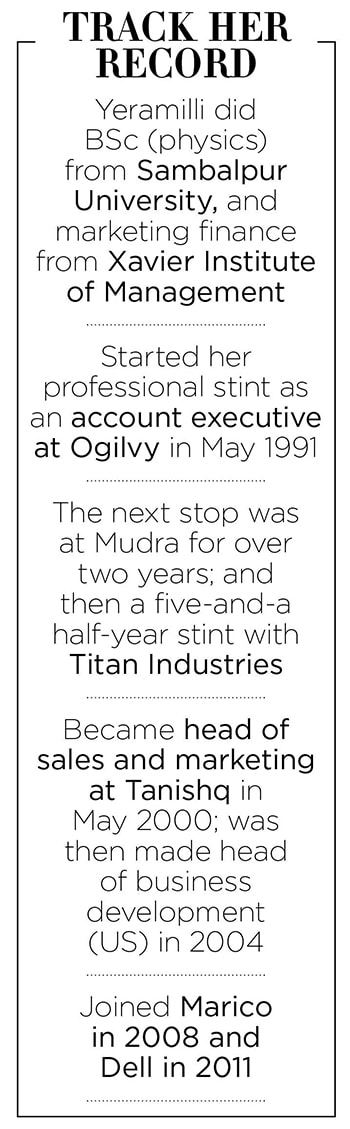

Yeramilli was hit hard by the assessment. Is this what 25 years of stellar performance—she started her professional stint at Ogilvy in 1991 and went on to add Mudra, Titan Industries, Marico and Dell to her CV—came down to, she wondered. For somebody who was instrumental in transforming Tanishq into an aspirational jewellery brand, rolled out the stores in the US, and was a pioneer in launching work-wear jewellery in India, it was hard for Yeramilli to believe that she was still looked upon as a rough diamond.

Five years later, Melorra hit a rough patch. Pounded by a savage pandemic, the country shut down in March 2020, and most of the businesses—especially discretionary ones like travel, hospitality and jewellery—came to a screeching halt. Melorra’s revenue slumped to zero in May, the business was fast running out of money, and Yeramilli started scouting for potential investors during the peak of Covid. “I had no choice. I had to pitch,” she recalls.

Five years later, Melorra hit a rough patch. Pounded by a savage pandemic, the country shut down in March 2020, and most of the businesses—especially discretionary ones like travel, hospitality and jewellery—came to a screeching halt. Melorra’s revenue slumped to zero in May, the business was fast running out of money, and Yeramilli started scouting for potential investors during the peak of Covid. “I had no choice. I had to pitch,” she recalls.

The task, though, was not easy for two reasons. First, the funders found the story surreal. “Are you crazy,” asked most of the VCs. “Log kapde nahin khareed rahe hain, gold kaun khareedega [people are not buying clothes, who will buy your gold],” they grilled Yeramilli on her ambitious forecast about the venture.

Back in 2016, the newbie founder bumped into her ‘Red Bull’ moment. This time a new set of cynics was chanting the word impossible. “Can you make jewellery in one week,” she asked scores of gold and diamond vendors across the country. Her ask was simple. Yeramilli wanted made-to-order, stylish, casual and trendy jewellery in record time. Her aspiration was to become the ‘Zara of Jewellery’ by rolling out a new collection every week.

Back in 2016, the newbie founder bumped into her ‘Red Bull’ moment. This time a new set of cynics was chanting the word impossible. “Can you make jewellery in one week,” she asked scores of gold and diamond vendors across the country. Her ask was simple. Yeramilli wanted made-to-order, stylish, casual and trendy jewellery in record time. Her aspiration was to become the ‘Zara of Jewellery’ by rolling out a new collection every week.

Though conceding that women have to live with the expectation of performing a stellar job at home as well as business, Yeramilli believes that women have a natural edge over men. “We have an innate, god-given gift of multitasking,” she says. Apart from brilliantly utilising it, what women just need to do is discard the traditional way of mental conditioning. She shares an anecdote.

Though conceding that women have to live with the expectation of performing a stellar job at home as well as business, Yeramilli believes that women have a natural edge over men. “We have an innate, god-given gift of multitasking,” she says. Apart from brilliantly utilising it, what women just need to do is discard the traditional way of mental conditioning. She shares an anecdote.